Structured Products

Structured financial solutions designed to address specific risk-return objectives.

Structured Products

Structured Products

At a Glance

Highly customisable to investors’ specific needs

Ability to design product features in order to articulate a particular market view

Potential to earn enhanced yields, based on market price movements

What are Structured Products?

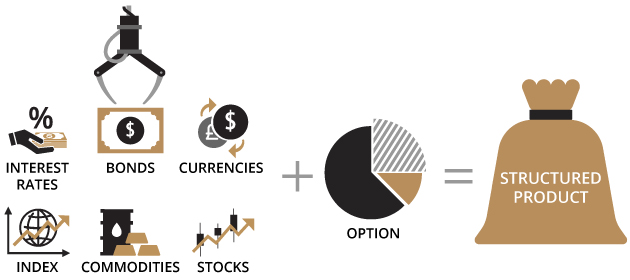

Structured products are financial instruments whose performance or value is linked to that of an underlying asset, product, or index. These may include market indices, individual or baskets of stocks, bonds, and commodities, currencies, interest rates or a mix of these.

Because of their huge variety, there is no simple definition—or uniform formula to calculate the risk and payoff—of structured products.

Generally, most structured products incorporate “options”, a type of derivative product that can give investors the right to buy or sell something at a pre-determined price (called “strike” price) and date. Conversely, it can also involve the investor giving a financial institution the right to buy from or sell to him something at a pre-determined price.

In a “call” option, the option holder has the right to buy the underlying asset at a certain price. In a “put” option, the option holder has the right to sell the underlying asset at a certain price.

Types of Structured Products

There are two broad categories of structured products offered in Singapore: structured deposits and structured notes.

| Structured Deposits | Structured Notes | |

|---|---|---|

| Return | Returns may be fixed or variable, depending on the structure or performance of underlying asset. | Apart from fixed and/or variable returns, there may even be capital appreciation depending on the performance of the underlying asset at maturity. Conversely, investors may receive less than their principal at maturity if the underlying asset performs against them. |

| Principal | Investors will receive their full principal (subject to the issuer’s credit risk) when they hold the structured deposit to maturity or during early redemption by the issuer (if applicable). | Investors may potentially lose part or the whole principal sum when the underlying asset performs against them. The principal amount is also exposed to counterparty risk, as structured products typically involve derivative arrangements with counterparties. |

a. Structured Deposits

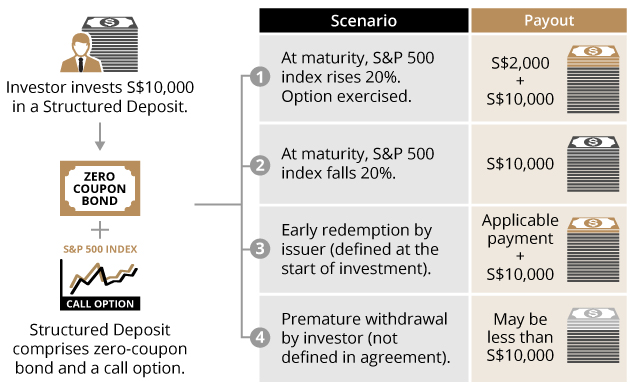

They typically have a zero-coupon bond and an option component. A zero-coupon bond pays no coupon but is purchased at a discount (for example, 80% of its maturity value). The remaining value (20% in this case) is used to purchase an option for the underlying asset of the structured deposit.

Instead of providing a regular coupon, a zero-coupon bond may, for example, be purchased at 80% of its maturity value. At maturity, it will pay the full value of the money invested.

If the structured deposit is bullish on US stocks, for example, the foregone coupon can be used to purchase a call option on the S&P 500 index—an index that tracks the US’ largest 500 companies by market capitalisation. If the S&P 500 index rises, the option is exercised to “call” or capture the upside gains in the index.

This principle can be applied to purchasing options in any market or security – hence, the diversity of structured deposits.

Some issuing financial institutions may also keep the investment proceeds in their reserve deposits to fund the payment of principal at maturity or buy options in the underlying asset, security or index.

A structured deposit may use different underlying “reference entities”, including:

- Baskets of stocks

- Single or multiple stock market indices and exchange traded funds

- Currencies

- Interest rates

Illustrative Example of an Index-Linked Structured Deposit:

If your market view of the underlying reference entity is correct, you will receive your enhanced return (see illustration above). But if your market view of the underlying is wrong, you will receive your principal back, with zero returns. This means you will lose the interest that you would otherwise have received on a fixed deposit. And early withdrawal of the deposit before its maturity date may incur a loss if the market valuation of the structured deposit is less than the principal.

In addition, unlike fixed deposits, structured deposits are not protected by the Singapore Deposit Insurance Corporation. Hence, it is important to be comfortable with the creditworthiness of the institution that issued the structured deposit.

b. Structured Notes

Unlike structured deposits, structured notes offer no principal guarantees (unless a third-party guarantees the payout of principal in the event the structured note issuer defaults).

Because there is a wide variety of structured notes in the market, there is no simple description of how they work. But they typically involve options: the structured note issuer either buys or sells an option on the reference asset or security, and the investor gives the issuer the right to put securities on or call securities from him/her.

Structured notes fall into three broad categories:

- Participating Notes (P-Notes): Their returns depend on the performance of an underlying financial instrument, such as equities, interest rates, credit spreads, market indices, fixed income instruments, foreign exchange, or a combination of these. As P-Notes carry significant risks, they are recommended only for investors with the appropriate risk appetite.

- Yield Enhancement Notes: You may potentially earn an enhanced yield if the performance of the underlying financial instrument is in line with your expected view. As yield enhancement notes carry significant risks, they are recommended only for investors with the appropriate risk appetite.

- Notes with Minimum Redemption of Principal at Maturity: These provide a minimum return on your principal, provided the notes are held to maturity. You may also potentially earn an enhanced yield and/or participate in the performance of the underlying financial instrument.

Some specific types of structured notes offered in Singapore include:

Benefits of Structured Products

| Issuers can tailor structured products to meet investors’ differing financial circumstances and needs. |

| Structured products offer potential yield enhancement, if your view of the market proves correct and the product issuer is credit-worthy. A structured deposit that offers repayment of the full principal at maturity can be a useful alternative to savings accounts, current accounts or term deposits. |

| Some structured notes offer strike prices—the price at which a call or put option is exercised—that are significantly below market prices; for example, 90% or 95% strikes. So even if the underlying securities fall below the initial price, but above the strike prices, the investor can still receive the principal plus the agreed “coupon”. If the prices of the stocks close on maturity above the initial price, the investor gets his principal plus coupon plus the upside of the reference equity. If the underlying is a basket of stocks, the investor receives the upside of the worst-performing stock. |

Risks of Structured Products

| As a structured product’s performance depends on the underlying asset’s or index’s performance, adverse price movements may cause a loss of capital. |

| Generally, investors will have no access to their principal for the tenor (or term) of the structured deposit or note, without incurring some risk of loss on the principal. For structured deposits, the principal protection only applies when held to maturity. |

| If the structured deposit or structured product issuer goes into debt default, the investor risks losing his/her entire principal. |

Note that specific structured products also carry product-specific risks. Please refer to the individual product pages for more information.

How to Apply