Funds Research and Insights

Showcasing the DBS Fund Selection Team (FST) and Fund publications.

Funds Research and Insights

At a Glance

Fund Selection Team

DBS Fund Selection Team (FST) is a dedicated group of professionals, committed to identifying high quality mutual funds which the team believes can add value for our clients.

The team assesses funds based on a forecasting model that emphasises a qualitative assessment of the fund’s competitive advantage relative to its peers and benchmark. The key elements to the selection process are:

- In-depth discussions conducted with the managers.

- Deep-Dive analysis of the portfolios, offering insights into the fund manager’s investment acumen.

- Review of drivers of past performance to isolate the qualities that are sustainable.

Based on these factors a conviction rating is assigned, expressing the view on the likelihood of the fund outperforming:

- Relative to a comparable asset class benchmark

- Relative to its peer group of similar strategies

- Over the next 18 to 36 months

This is followed by on-going monitoring and reviews of the performance of the funds.

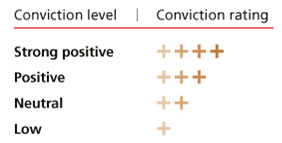

There are four Fund Conviction Levels and Ratings:

The higher the conviction rating, the better FST expects the fund to perform relative to its peers and asset class benchmark. However, it is important to note that Fund Rating is not a view on funds as an asset class nor guarantee of a fund’s performance.

Need some guidance on the selection of funds? Look out for Focus Funds1, our top picks on positively-rated funds every quarter using the Fund Search Tool.

1Focus Funds are a short-list of our positively rated funds that are aligned with bank’s current investment views.

Focus Funds

Focus Funds are the FST’s shortlist of positively-rated funds that are aligned with bank’s current investment views. Updated quarterly, this list serves to guide investors to navigate multiple investment opportunities that are topical.

Fund Selection List

DBS Fund Select List represents picks of some of FST’s positively-rated funds in core asset classes. Published on a quarterly basis, this list seeks to guide our clients in navigating the multiple investment opportunities in core asset classes, and serves as a reference for the team’s favourite qualitatively selected funds.

FST Three Fund Models

DBS FST Three Fund Models are simple, easy to implement portfolios using three conviction funds to create well-diversified portfolio. There are three portfolios that have different mixes of Equity, Fixed Income, and Alternative exposure to produce different levels of portfolio risk that may be appropriate of different investors. The models use the CIO Office Strategic Asset Allocations as a reference point, but can and do diverge from them.